38+ Mortgage interest deduction calculator

There are some deductions which are more common than others. A document published by the Internal Revenue Service IRS that provides information on deducting home mortgage interest.

2020 2021 Tax Estimate Spreadsheet Higher Order Thinking Skills Interactive Lesson Plans Student Orientation

Use our Mortgage Tax Deduction Calculator to determine your mortgage tax benefit based on your loan amount interest rate and tax bracket.

. Follow the mentioned steps to calculate mortgage interest deduction limit. Taxable Income w Standard. For taxpayers who use married filing separate.

This allows you to deduct the interest on the mortgage you paid for buying a home building or improving the main home or second home. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Estimate your monthly payments with PMI taxes homeowners insurance HOA fees current.

The initial interest rates are normally 05 to 2 lower. As noted in general you can deduct the mortgage interest you paid during the tax year on the first 1 million of your mortgage debt for your primary home or a second home. Here is an example of what will be the scenario to some people.

Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. See How Much You Can Save. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Calculate Interest payment as shown below. Divide the maximum debt limit. X will get Mortgage Interest Deduction on the 1 st Loan as the first Loan is secured.

Use this calculator to see how much you could save. Get Top-Rated Mortgage Offers Online. The terms of the loan are the same as for other 20-year loans offered in your area.

The interest you pay on your mortgage or any points you paid when you took out your loan could be tax deductible. Ad Calculate Your Payment Fees More with a FHA Home Loan Expert. Please note that if your mortgage closed on or.

That means this tax year single filers and married couples filing jointly can deduct the interest on up to 750000 for a mortgage if single a joint. In 2021 you took out a 100000 home mortgage loan payable over 20 years. IRS Publication 936.

Ad Calculate Your Payment Fees More with a FHA Home Loan Expert. The truth is that the tax code is written in such a way that some deductions just apply to more individuals. See How Much You Can Save with Low Money Down Low Interest Rates.

Your clients want to buy a house with a mortgage of 1200000. See How Much You Can Save with Low Money Down Low Interest Rates. The new caps will affect owners of.

You paid 4800 in points. If you own a home you may not be aware of the. Top-Rated Mortgage Rates 2022.

Under the new tax plan which takes effect for the 2018 tax year on new mortgages you may deduct the interest you pay on mortgage debt up to 750000 on your. This calculator computes your clients qualified mortgage loan limit and the deductible home mortgage interest. Ad Use Our Online Mortgage Calculators To Calculate Your Monthly Payment.

The new deductions mean that homeowners dont always need to itemize interest costs. You can deduct the part of your interest paid on the amount of debt below the limit. Ad Compare Lowest Mortgage Lender Rates Today in 2022.

This calculator is for. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to 750000. Much of their mortgage interest could fit with the new deduction.

Today the limit is 750000. So the total Interest that is 1000000 5 50000 will. Check out the webs best free mortgage calculator to save money on your home loan today.

If you have a mortgage that is in the amount of 250000 and you have an interest rate that is set at 65 percent for a loan term. The tentative new Republican party tax plan for 2018 intends to reduce the home mortgage interest deduction from 1000000 in mortgage debt to 500000 in mortgage debt while also.

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Free Printable Vehicle Expense Calculator Microsoft Excel Templates Printable Free Bookkeeping Templates Agenda Template

Free 25 Printable Irs Mileage Tracking Templates Gofar Mileage Log For Taxes Template Excel Report Template Professional Templates Business Template

Use The Interactive Online Emi Calculator To Calculate Your Home Loan Emi Get All Details On Inter Life Insurance Premium Life Insurance Calculator Income Tax

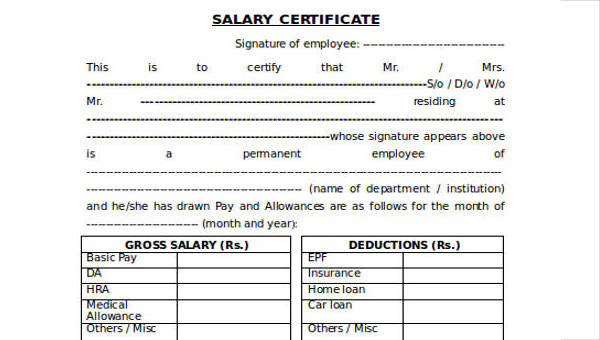

Free 38 Certificate Forms In Ms Word

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Net Worth Calculator Balance Sheet Assets And Liabilities Etsy Excel Spreadsheets Statement Template Balance Sheet

Taxes The Ascent By Motley Fool Tax Credits Renovations Renewable Energy Systems

Laugh For The Day Tax Deduction In 2022 Crazy Cats Cat Jokes Funny Cats

Mortgage Refinance Calculator Excel Spreadsheet Refinance Mortgage Mortgage Refinance Calculator Refinance Loans

Home Business Worksheet Template Business Worksheet Business Tax Deductions Home Business

Qualified Nc Child Support Calculator Worksheet B Ncchildabduction Ncchildadoption Ncchi Personal Financial Statement Financial Statement Statement Template

Installment Loan Payoff Calculator In 2022 Loan Calculator Mortgage Amortization Calculator Amortization Schedule

How To Deduct Property Taxes On Irs Tax Forms Irs Tax Forms Mortgage Interest Irs Taxes

What Is A Schumer Box And How Do You Read It Nerdwallet Good Credit Best Credit Cards Reading

Investment Property Expense List For Taxes Investing Investment Property Being A Landlord

Real Estate Lead Tracking Spreadsheet